dupage county sales tax vs cook county

8158 Illinois has state sales tax of 625 and allows. The average sales tax for a state is 509.

The Story Of Why Real Estate Taxes Are Paid In Arrears And How Property Tax Prorations Work Chicago Real Estate Closing Blog

Dupage county vs cook county1959 nascar standings dupage county vs cook county.

. Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425. In DuPage County property tax rates vary widely between suburbs with 2005 taxes rates ranging from 82058 for Glendale Heights down to 27896 for Oak Brook. Dupage County Illinois Sales Tax Rate.

Lake Zurich being in Lake County wouldnt have the heavy sales-tax burden that Cook County. I am in Dupage. Thanks to the DuPage County sales tax reduction the new rate for services and parts is 75 and the new rate for.

Fast Easy Tax Solutions. 625 Average Sales Tax With Local. In 2018-2019 more than one-in-seven 150 percent kindergarten sixth and ninth grade public school students in DuPage County had obesity.

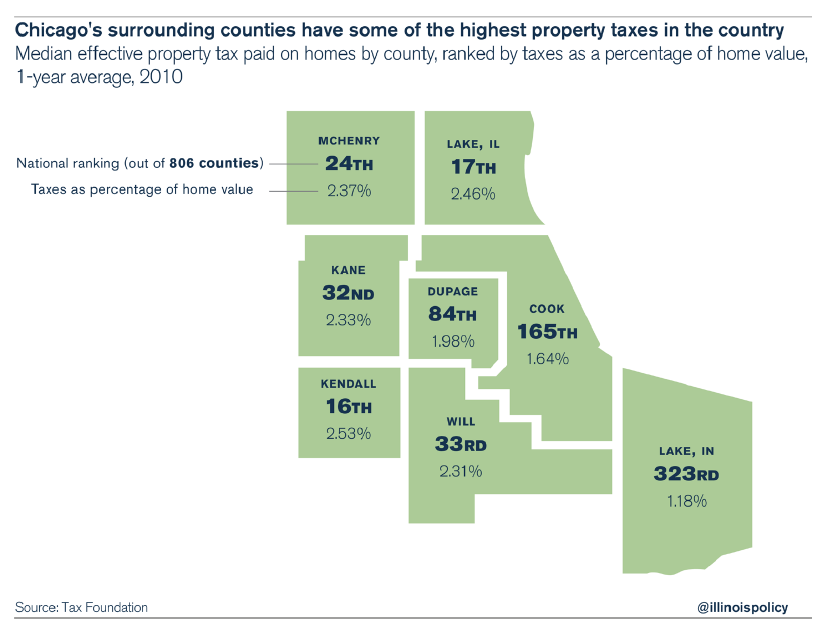

Side-by-side comparison between Cook county IL and DuPage county IL using the main population demographic and social indicators from the United States Census. At the time the average rate for Cook County including municipal sales tax was about 216 percentage points higher than in DuPage Kane Lake McHenry and Will counties. At the time the average rate for Cook County including municipal sales tax was about 216 percentage points higher than in DuPage Kane Lake McHenry and Will counties.

1337 rows Lowest sales tax 625 Highest sales tax 115 Illinois Sales Tax. Taxes might be slightly less there than in towns to the east but not likely by that much. 32 states fall above this average and 18 states fall below this average suggesting that the few states with a sales tax of 0 bring.

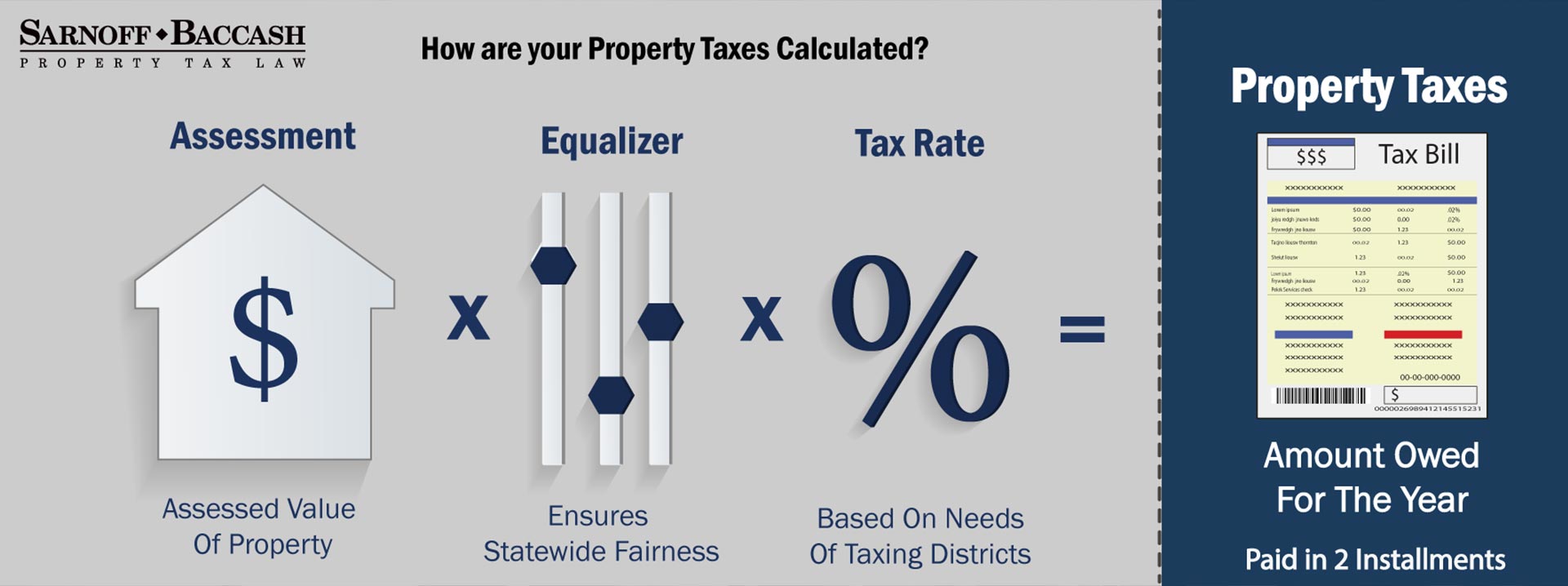

These rates were based on a tax hike that dates to 1985. PLEASE CONTACT THE DU PAGE COUNTY CLERK AT 630-407-5500 for an Estimate of. If youre looking to buy a house the two big numbers youll want to.

Cook has higher sales taxes but both Cook and DuPage have higher property taxes depending on which town youre in. In cook county outside of chicago its 775 percent. Recently I looked online at a 2 flat in a Cook County suburb and nearly fell out of my chair when the real estate agent told me what the property taxes were.

Below are the most relevant links to cost of living dupage county vs cook county data. So if a county. Cook has a slightly higher sales tax.

If your Property Taxes are Sold at the Annual Tax Sale Held on November 1718 2022. What episode does jace cheat on clary. The Illinois sales tax of 625 applies countywide.

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

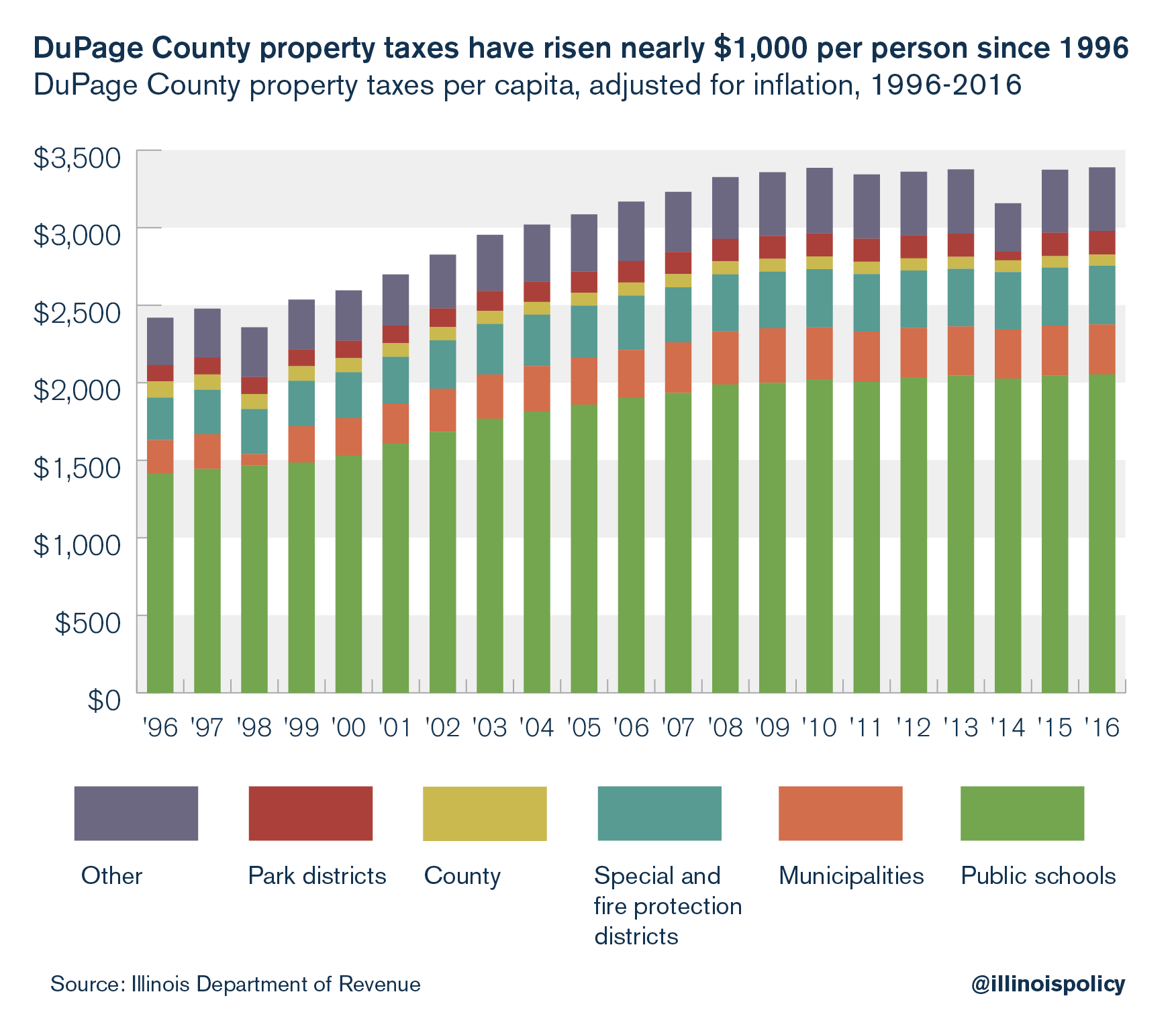

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Cities In Cook County Complete List Of Cook County Cities Towns Villages With Population Data Map Information More

Six Places Chicagoans Will Flee To If Property Tax Increases Are Part Of Chicago S Pension Fix

Busting The Myth That Chicago Taxes Are Low Illinois Policy

Property Tax Resources In Chicago Il Sarnoff Baccash

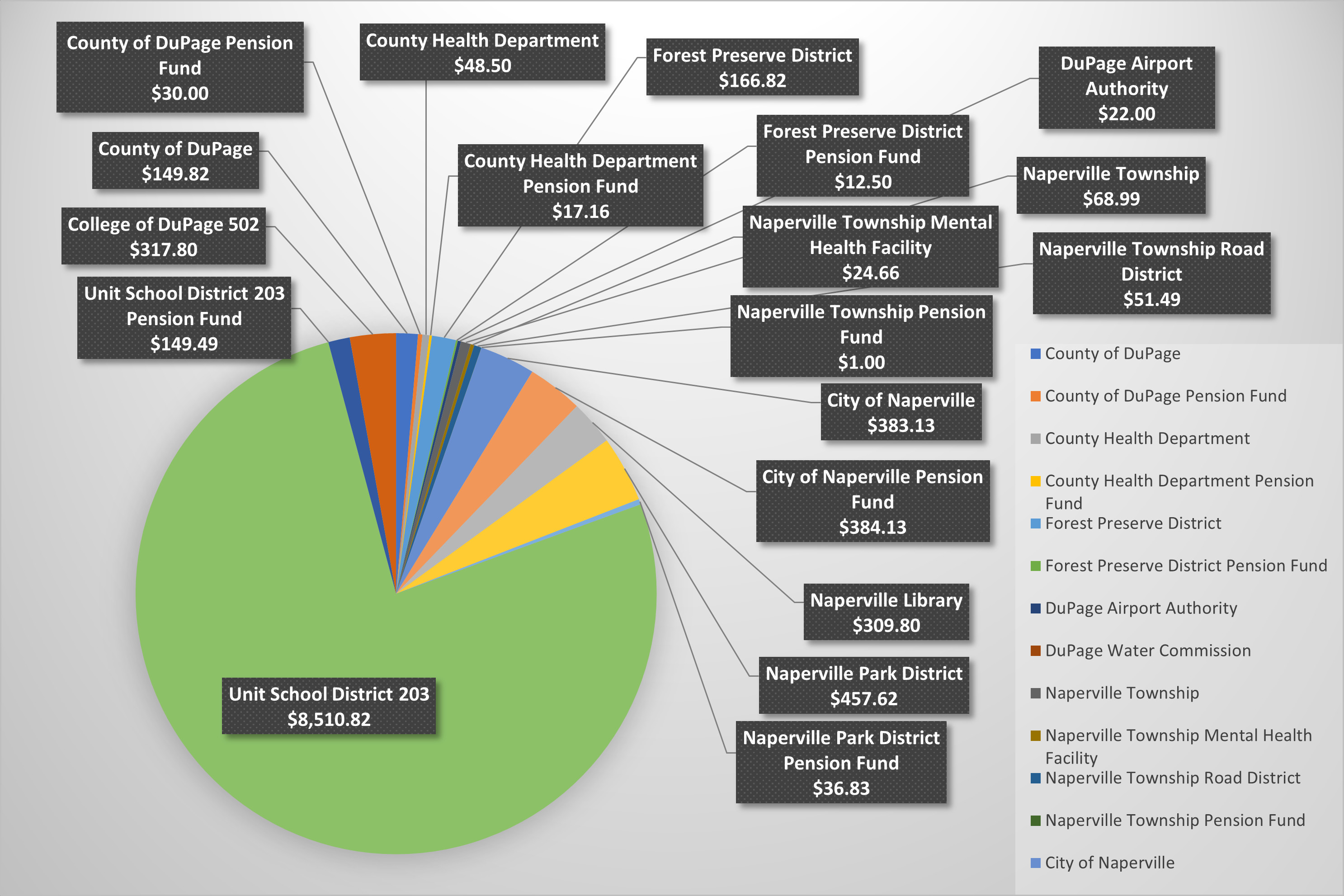

About Assessor Naperville Township

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Dupage Property Tax Due Dates Fausett Law Office

Dupage County Illinois Ballot Measures Ballotpedia

Cook County Illinois Ballot Measures Ballotpedia

Sales Tax Information Bureau County Government Princeton Il

Dupage County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More